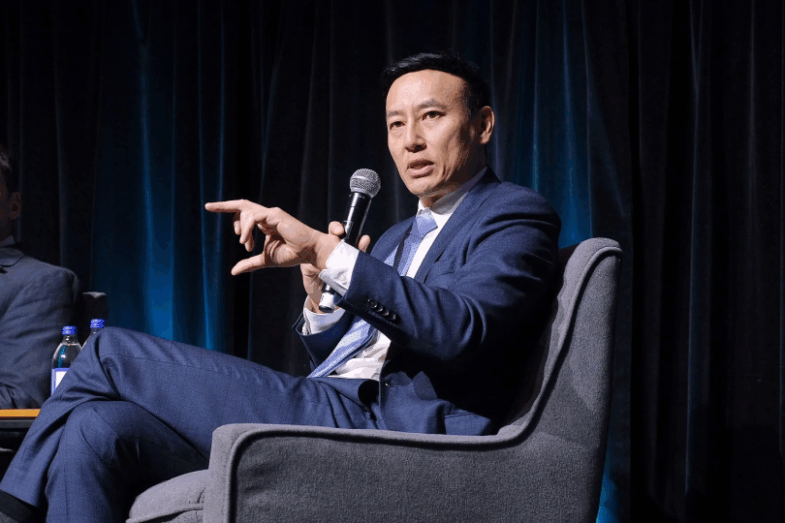

At the Global Property Market Closing Roundtable on December 2, 2025, QuadReal’s Toby Wu, Executive Vice President of Development, joined a cross-section of industry leaders to share insights on investment strategies, asset class trends, and building resilience across global portfolios.

The discussion explored risk and return, core vs. value-add vs. opportunistic strategies, and how decision-makers are approaching capital deployment across office, industrial, retail, and multi-residential assets. Below, Toby shares QuadReal’s approach to today’s most pressing industry questions.

Which investment strategies are attracting the most interest today?

Decision-makers are weighing core, value-add, and opportunistic approaches. At QuadReal, we’re focused on creating long-term value by investing across global and domestic debt and equity. Our investment approach is rooted in areas of conviction including multifamily, industrial, and select alternative assets like self-storage and data centres.

How does QuadReal keep a competitive edge?

It starts with boots on the ground. Our vertically integrated model—in-house development, asset management, operations, and property management—drives operational efficiencies and builds resilience across our portfolio. When it comes to developing, managing, and operating our buildings, we listen to what our customers want, whether that’s on the commercial or residential side. This results in compelling spaces that ultimately attract tenants.

Are we entering a new cycle of global capital reallocation?

Yes, we have witnessed the resetting of rates and the turning of fundamentals. Over the last few years, our strategy has shifted from building yield to acquiring income-producing properties, especially internationally. Development is not fully off the table, particularly in Canada, but we are being highly selective about the markets and sectors.

How do we build resilience across global portfolios?

Operational efficiencies and active asset management are key to driving resilience. QuadReal directly manages 80% of its AUM through twelve operating platforms, giving us the ability to optimize business operations and leverage local expertise to drive NOI.

Why This Matters

As global real estate markets continue to shift, strategic agility and operational strength are critical for long-term success. QuadReal’s approach reflects a commitment to innovation, resilience, and delivering value across asset classes worldwide.